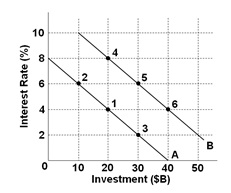

If the economy was initially in equilibrium at point 3 and a government deficit makes interest rates increase by 4 percentage points, then the crowding-out effect would be a reduction of:

Refer to the above graph.

A. $10 billion in investment

B. $20 billion in investment

C. $30 billion in investment

D. $6 billion in investment

B. $20 billion in investment

You might also like to view...

If a positive permanent supply shock were to occur, the resulting equilibrium would be a:

A. higher level of output at lower prices. B. lower level of output and prices. C. higher level of output and prices. D. lower level of output at higher prices.

An expansionary fiscal policy will result in higher interest rates and will reduce private investment.

a. true b. false

An investment pays $1,500 half of the time and $500 half of the time. Its expected value and variance respectively are:

A. $2,000; (250,000 dollars)2 B. $1,000; 250,000 dollars C. $1,000; 250,000 dollars2 D. $1,000; 500,000 dollars

Other things equal, an improvement in the expected rate of net profit would:

A. Reduce the price level and unemployment B. Decrease the interest rate and cause aggregate demand to increase C. Increase consumption and net exports, causing aggregate demand to shift rightwards D. Increase investment spending, real GDP, and the price level