The U.S. income tax

a. discourages saving.

b. encourages saving.

c. has no effect on saving.

d. will reduce the administrative burden of taxation.

a

You might also like to view...

Representative commodity money retained its value because

A) it was an actual commodity. B) it was a fiat money. C) it was backed by the government. D) it could be exchanged for an actual commodity.

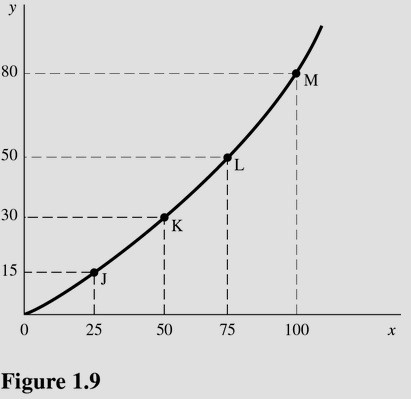

In Figure 1.9 the slope of the line is

In Figure 1.9 the slope of the line is

A. Greater at point M than point L. B. The same at points J and K. C. Greater at point K than point L. D. Equal to zero at all points.

What is the problem with saving in DVCs, even when saving as a percentage of domestic output is the same as in industrially advanced countries?

A. The interest rate paid on money kept in a bank in DVCs is not as high as the interest rate on money kept in a bank in an IAC B. Capital flight reduces investment opportunities and the need for saving in DVCs C. There is a continual brain drain that removes skilled labor from the work force and reduces labor productivity and the need for saving D. The domestic output of DVCs is so low that the absolute volume of saving is small

The motive for the erecting trade barriers to import goods and services from abroad is to

A. improve economic efficiency in that nation. B. protect and benefit special interest groups in that nation. C. reduce the prices of the goods and services produced in that nation. D. expand the export of goods and services to foreign nations.