How do new classical economists differ from Keynesian economists in their assumptions about how government borrowing affects household consumption and borrowing patterns?

Keynesian economists believe households will treat a reduction in taxes financed by borrowing as an increase in income and wealth and will, therefore, increase consumption. New classical economists believe households will reduce consumption and save the tax cut to pay the higher future taxes implied by the government borrowing. According to new classical economists, taxes and debt financing are essentially equivalent.

You might also like to view...

The marginal rate of substitution measures the slope of the:

a. total utility curve. b. demand curve. c. budget line. d. indifference curve.

Diminishing marginal product occurs when

a. the increases to total output are declining. b. marginal product is negative. c. total output is decreasing. d. All of the above are correct.

Which of the following statements about inflation is correct?

a. Evidence from studies indicates that, in U.S. newspapers, inflation is mentioned less frequently than other economic terms, such as unemployment and productivity. b. People believe the inflation fallacy because they tend to believe too strongly in the principle of monetary neutrality. c. Nominal incomes are determined by nominal factors; they are not affected by real factors. d. Inflation does not in itself reduce people's real purchasing power.

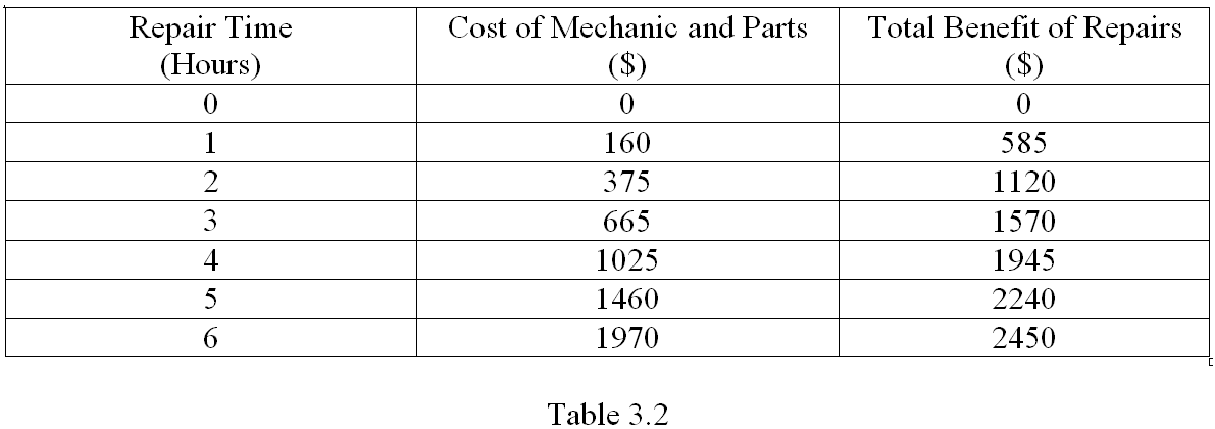

Refer to Table 3.2, which shows some costs and benefits of having your car repaired. What is the marginal benefit of the 4th hour spent on repairs?

A. $450

B. $375

C. $295

D. $920