A commercial bank recognizes that its net income suffers whenever interest rates increase. Which of the following strategies would protect the bank against rising interest rates?

A. Buying inverse floaters.

B. Entering into an interest rate swap where the bank receives a fixed payment stream, and in return agrees to make payments that float with market interest rates.

C. Purchase principal only (PO) strips that decline in value whenever interest rates rise.

D. Enter into a short hedge where the bank agrees to sell interest rate futures.

E. Sell some of the bank's floating-rate loans and use the proceeds to make fixed-rate loans.

Answer: D

You might also like to view...

Recent surveys have reported that ______ women have experienced sexual harassment in the United States.

A. 1 in 4 B. 1 in 10 C. 1 in 20 D. 1 in 100

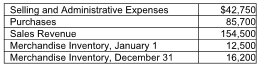

Mason sold 950 cabinets during the year. Calculate the operating income for the year. Compute the unit cost for one cabinet (Round to two decimal places.)

Mason Cabinet Company sells standard kitchen cabinets. The following information summarizes

Mason's operating activities for the year:

Which of the following business application programs would encourage collaboration of workers dispersed throughout the company to work together in real time on projects?

a. Lotus 1-2-3 b. Word Perfect c. Lotus Notes d. COBOL e. Excel

What is anticipation inventory and what are the benefits and drawbacks of having it?

What will be an ideal response?