Production costs per tennis racket total $38, which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced). Ten percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Aces, Inc., a manufacturer of tennis rackets, began operations this year. The company

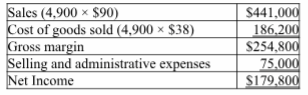

produced 6,000 rackets and sold 4,900. At year-end, the company reported the following income statement using absorption costing.

A) $194,100

B) $165,500

C) $311,000

D) $240,500

E) $233,000

B) $165,500

Explanation: $179,800 – ($13 × 1,100 units) = $165,500

Income under absorption costing = Income under variable costing + FOH in Ending inventory –FOH in Beginning inventory

$179,800 = Income under variable costing + (1,100 units × FOH $13) – (0 units × FOH $13)

$179,800 = Income under variable costing + $14,300 – $0

$165,500 = Income under variable costing

You might also like to view...

Which is true of early technical support efforts?

A. Supporting technology was a primary focus of most companies. B. Developers developed software while analysts handled support issues. C. Users often had no idea of whom to call for support questions. D. Recurring problems were quickly identified and resolved.

____ skills include the understanding of the importance of meeting a customer's needs.

A. Business B. Soft C. Analytical D. Customer service

Careful analysis of law and ethics leads to the conclusion that ________

A) many illegal activities are also unethical B) ethics lays the foundation for laws C) lawyers are at heart ethicists D) legal advice and ethical advice are essentially the same

With an open-door policy, decisions tend to be consistent across managers.

Answer the following statement true (T) or false (F)