If the federal government replaced the current income tax with a national sales tax, the price of:

A. corporate bonds would fall while the price of municipal bonds would rise.

B. corporate bonds and municipal bonds would rise.

C. municipal bonds would fall while the price of corporate bonds would rise.

D. municipal bonds would rise and corporate bonds would not change.

Answer: C

You might also like to view...

The theory that suggests that our unlimited wants will lead to perpetual economic growth is the

A) classical growth theory. B) old growth theory. C) sustained growth theory. D) Malthusian growth theory. E) new growth theory.

A tax on buyers increases the size of a market

a. True b. False Indicate whether the statement is true or false

Which of the following conditions must hold if a consumer is maximizing her utility?

A. MUX × PX = MUY × PY B. MUX = MUY C. MUX/PY = MUY/PX D. MUX/PX = MUY/PY

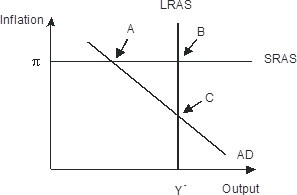

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A