Compute the net pay for Karen Wilson and Katie Smith by completing the payroll register below.

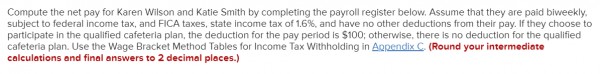

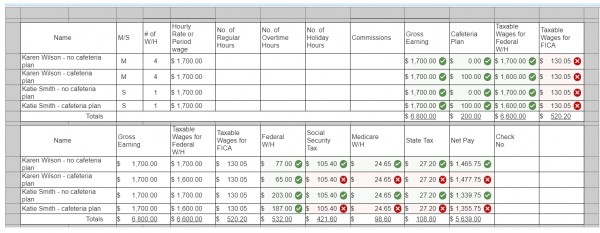

Compute the net pay for Karen Wilson and Katie Smith by completing the payroll register below. Assume that they are paid biweekly, subject to federal income tax, and FICA taxes, state income tax of 1.6%, and have no other deductions from their pay. If they choose to participate in the qualified cafeteria plan, the deduction for the pay period is $100; otherwise, there is no deduction for the qualified cafeteria plan. Use the Wage Bracket Method Tables for Income Tax Withholding in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.)

You might also like to view...

The “Me” part of the self is the ______.

a. doer or performer b. actualized self c. critic or judge d. possible self

Evaluators should conduct formative meta-evaluations on their data collection instruments.

a. True b. False

Interest on bonds is tax deductible.

Answer the following statement true (T) or false (F)

On March 12, Klein Company sold merchandise in the amount of $8600 to Babson Company, with credit terms of 2/10, n/30. The cost of the items sold is $4900. Klein uses the perpetual inventory system and the net method of accounting for sales. On March 15, Babson returns some of the merchandise, which is not defective. The selling price of the returned merchandise is $680 and the cost of the merchandise returned is $390. The entry(ies) that Klein must make on March 15 is (are):

A.

| Accounts receivable | 680? | |

| Sales returns and allowances | 680? |

B.

| Sales returns and allowances | 390? | |

| Accounts receivable | 390? |

C.

| Sales returns and allowances | 666? | |

| Accounts receivable | 666? | |

| Merchandise inventory | 382? | |

| Cost of goods sold | 382? |

D.

| Accounts receivable | 680? | |

| Sales returns and allowances | 680? | |

| Cost of Goods Sold | 390? | |

| Merchandise inventory | 390? |

E.

| Sales returns and allowances | 666? | |

| Accounts receivable | 666? | |

| Merchandise inventory | 390? | |

| Cost of goods sold | 390? |