A tax meant to counter the effect of a negative externality is called:

A. an external tax.

B. a social benefit tax.

C. a Coase tax.

D. a Pigovian tax.

Answer: D

You might also like to view...

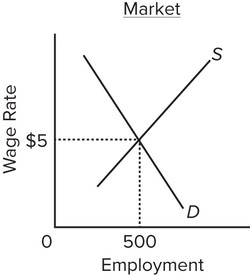

Use the following diagram to answer the next question. Which of the following statements about this market is not correct?

Which of the following statements about this market is not correct?

A. A wage rate of $5 maximizes the number of workers employed. B. Employers would benefit from a higher wage since they could profitably attract more workers. C. At a wage rate greater than $5 less than 500 workers would be employed. D. At a wage rate less than $5, less than 500 workers are supplied, so no more can be employed.

The transactions demand for money increases when more people want to hold some of their wealth in the form of money to reduce the risks associated with unexpected emergencies

a. True b. False Indicate whether the statement is true or false

The natural rate is natural in the sense that macroeconomic policy

a. sees it all the time b. can ignore it c. can't do much about it d. is a natural reaction to unemployment e. has always recognized that some workers will be voluntarily unemployed

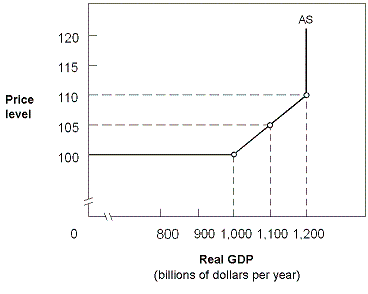

Exhibit 10-6 Aggregate supply curve

A. there are no more workers available at any wage rate to increase real GDP. B. the price level remains constant. C. the only workers available would demand higher wage rates. D. the economy is experiencing low employment and low production.