A Big Mac costs $4.00 in the United States and 9.00 reals in Brazil. If the exchange rate is 2 reals per dollar, purchasing power parity predicts that

A) the dollar will depreciate as the supply of dollars rises in the long run.

B) the dollar will appreciate in the long run as the demand for the dollars rises.

C) the dollar will appreciate as the demand for dollars falls in the long run.

D) the dollar will depreciate as the demand for dollars falls in the long run.

B

You might also like to view...

Explain why Relative PPP is useful when comparing countries that base their price levels on different product baskets

What will be an ideal response?

Refer to Scenario 17.4. If the flood control system were not in place, the insurer would not be willing to insure against the flood for any premium less than

A) $5,000. B) $10,000. C) $100,000. D) $200,000. E) $1,000,000.

Exit from a perfectly competitive industry causes the market supply curve to shift to the left, resulting in a lower quantity of output and a higher price

a. True b. False Indicate whether the statement is true or false

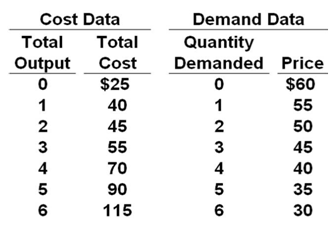

Refer to the below tables. What output and price levels will maximize the firm's profit in the short run?

Assume that the short-run cost and demand data given in the tables below confront a monopolistic competitor selling a given product and engaged in a given amount of product promotion.

A. 3 units and $45

B. 4 units and $40

C. 5 units and $35

D. 6 units and $30