To hedge the interest rate risk on $4 million of Treasury bonds with $100,000 futures contracts, you would need to purchase

A) 4 contracts.

B) 20 contracts.

C) 25 contracts.

D) 40 contracts.

D

You might also like to view...

Refer to the scenario above. In equilibrium, Beth's payoff is ________

A) $10 B) $0 C) $20 D) $50

Suppose an MNC subsidiary buys 100 input units from its parent at a price of $2 each. It has $300 in additional production costs, and sells its 100 units of output for $6 to the MNC. It pays a 25% local profit tax

The MNC sells the output at home for $8, and its cost of producing inputs is $1 . It pays a profit tax of 20% at home on repatriated profits. What is the subsidiary net profit? Assume no selling costs at home. What is the MNC's total profit from the operation?

What is the unemployment rate in a town in which 65,400 persons are employed and 11,000 are unemployed?

a. 20.2 % b. 16.8% c. 14.4% d. 11%

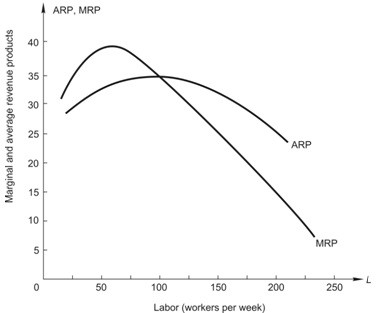

To answer the question, refer to the following figure, showing the marginal revenue product (MRP) and the average revenue product (ARP) curves of a perfectly competitive firm hiring a single variable input, labor. If the wage is $20, how many workers will the firm hire?

If the wage is $20, how many workers will the firm hire?

A. 200 B. 175 C. zero D. 225