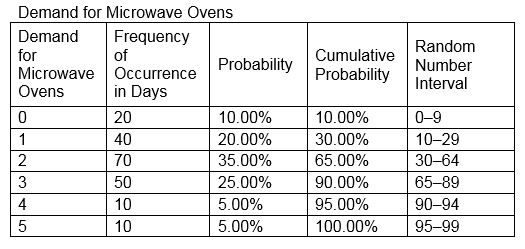

Consider the Demand for Microwave Ovens data set. What is the total demand corresponding to random numbers 69, 29, 56, 8, 83, and 55?

A. 8

B. 9

C. 10

D. 11

D. 11

You might also like to view...

Ownership of personal property is governed by federal law.

Answer the following statement true (T) or false (F)

Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $8738.00. The FICA tax for social security is 6.2% of the first $128,400 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of 0.6% and the SUTA tax rate of 5.4% are applied to the first $7000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1449.87. What is the total amount of taxes withheld from the Portia's earnings? (Round your intermediate calculations to two decimal places.)

A. $2118.33 B. $2552.33 C. $2172.00 D. $3621.87 E. $1576.57

Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company: Salaries expense $24,000 Social Security and Medicare taxes withheld 1,100 Income taxes withheld 5,000 Medical insurance deductions 500 Life insurance deductions 400 Salaries subject to federal and state unemployment taxes of 6.2 percent

8,000 The entry to record the payment of net payroll would include a A) debit to Salaries Payable for $24,000. B) debit to Salaries Payable for $15,900. C) debit to Salaries Payable for $17,000. D) credit to Cash for $18,100.

Which of the following is an example of a variable cost for an amusement park?

A) salary of the park manager B) food cart supplies C) liability insurance D) interest on the property's mortgage E) property taxes