A company issues 8% bonds with a par value of $40,000 at par on January 1. The market rate on the date of issuance was 7%. The bonds pay interest semiannually on January 1 and July 1. The cash paid on July 1 to the bond holder(s) is:

A) $3,200.

B) $2,800.

C) $1,600.

D) $1,400.

E) $0.

C) $1,600.

Explanation: $40,000 * .08* 1/2 year = $1,600

You might also like to view...

A balance sheet account that is usually reported at fair value is

A) Marketable Securities. B) Land. C) Accounts Payable. D) Inventory.

Answer the following statements true (T) or false (F)

1. When a company invests in equity securities with 20% to 50% ownership in the investee's voting stock, the investor can significantly influence the investee's decisions. 2. Investments accounted for by the equity method are recorded at cost at the time of purchase. 3. Significant influence equity investments must be accounted for using the equity method. 4. Under the equity method, the Equity Investments account is debited for the receipt of a dividend because the dividend increases the investee's equity.

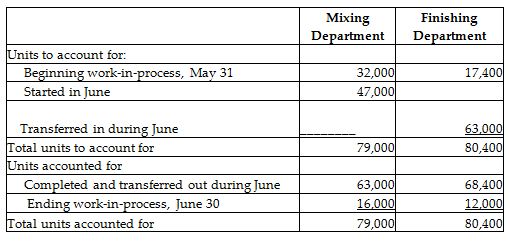

Selected production and cost data of Rivera Manufacturing Company follow for June:

On June 30, the Mixing Department's ending Work-in-Process Inventory was 80% complete for materials and 40% complete for conversion costs. The Finishing Department's ending Work-in-Process Inventory was 75% complete for materials and 60% complete for conversion costs. The weighted-average method is used.

Requirements:

1. Compute the equivalent units of production for direct materials and for conversion costs for the Mixing Department.

2. Compute the equivalent units of production for transferred in costs, direct materials, and conversion costs for the Finishing Department.

Most states treat the deed of trust different from a mortgage in giving the borrower a relatively short period of time to redeem the property.

Answer the following statement true (T) or false (F)