Would a tax on prescriptions drugs be more likely to be progressive or regressive? Why?

A tax on prescriptions drugs would most likely be regressive. Prescription medication is essentially a necessity. The dollar amount of the taxes would not vary between households based on income. However, the same dollar amount would represent a smaller percentage of the income for a high-income household while representing a larger percentage of the income of a low-income household.

You might also like to view...

The figure above portrays a total revenue curve for a perfectly competitive firm. Curve A is straight because the firm

A) is a price taker. B) faces constant returns to scale. C) wants to maximize its profits. D) has perfect information.

A short-run appreciation of the British pound would be consistent with:

a. a temporary fall in the British money supply. b. a temporary fall in the European money supply. c. a temporary rise in the European money supply. d. either a temporary fall in the British money supply or a temporary rise in the European money supply.

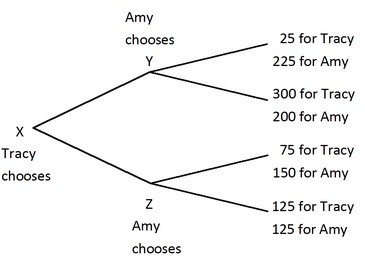

Tracy and Amy are playing a game in which Tracy has the first move at X in the decision tree shown below. Once Tracy has chosen either the top or bottom branch at X, Amy, who can see what Tracy has chosen, must choose the top or bottom branch at Y or Z. Both players know the payoffs at the end of each branch. In the equilibrium this game, Tracy chooses the ________ branch, and then Amy chooses the ________ branch.

In the equilibrium this game, Tracy chooses the ________ branch, and then Amy chooses the ________ branch.

A. bottom; top B. top; bottom C. top; top D. bottom; bottom

If you were running an advertising campaign for designer men's suits, you should target families with:

A. poor taste in clothing. B. lower incomes. C. similar tastes and preferences. D. higher incomes.