Why were traditional Federal Reserve policies ineffective during the 2007-2009 recession?

What will be an ideal response?

The traditional Fed policy response to a recession is to reduce the short-term nominal interest rate. Normally, this will decrease the long-term real interest rate, so long as term structure effects, the default-risk premium, and the expected inflation rate remain constant. This traditional policy could not operate during much of the recession because the target for the federal funds rate had been lowered to near zero by the end of 2008. This forced the Fed to adopt new policies to attempt to increase real GDP and employment.

You might also like to view...

People generally purchase less of a commodity as its price increases. This implies that the relationship between quantity purchased and the price of the commodity must have a

a. slope always equal to one. b. positive slope. c. zero slope. d. negative slope.

For a firm in a perfectly competitive industry,

A) both short-run and long-run economic profits may be negative.

B) short-run economic profits must be zero.

C) short-run economic profits may be positive, but long-run economic profits must be zero.

D) short-run and long-run economic profits must be zero.

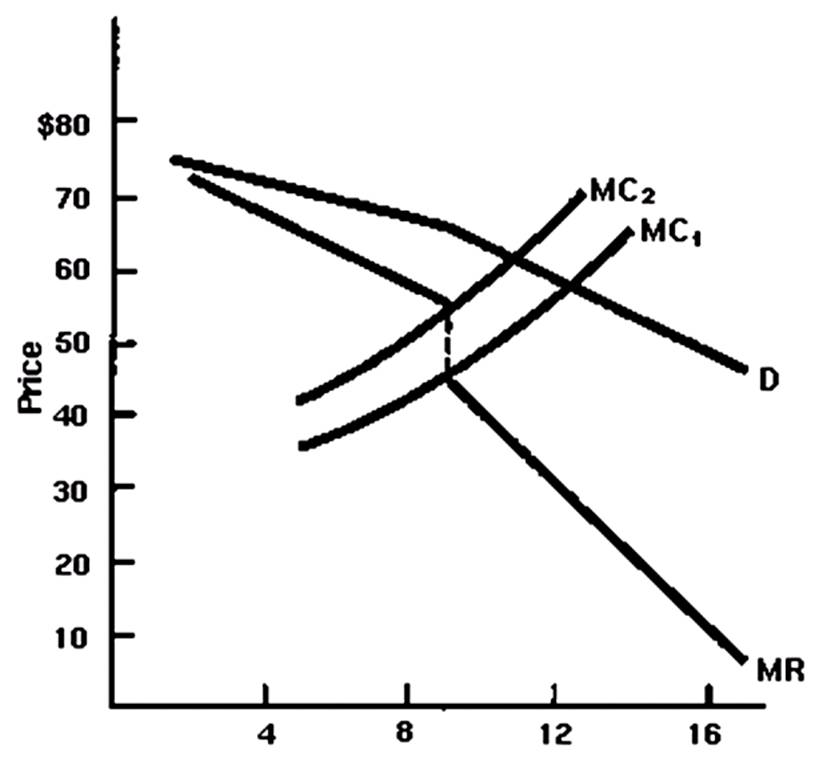

The price charged by this profit-maximizing firm is ___ and its output is ___ (assume marginal cost is MC1).

A. $45; 9

B. $45; 11

C. $65; 9

D. $65; 11

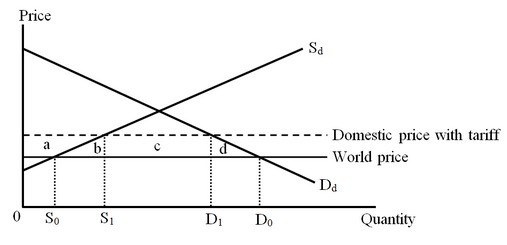

The figure below shows the market for shoes in a small importing country. Dd and Sd are the domestic demand and supply curves of shoes, respectively. The consumption effect of the tariff on shoes is measured by the area

The consumption effect of the tariff on shoes is measured by the area

A. b. B. c. C. (a + b + c + d). D. d.