The IS curve ________

A) shows the relationship between aggregate output and the real interest rate when the goods market is in equilibrium

B) tells us that increases in autonomous consumption, investment, government purchases, or net exports raise output for any real interest rate

C) tells us that a decrease in taxes or in financial frictions leads to an increase in output for any given real interest rate

D) all of the above

E) none of the above

D

You might also like to view...

During 2012, a country has consumption expenditures of $3.0 trillion, investment expenditures of $1.5 trillion, government expenditure of $1.5 trillion, exports of $1.0 trillion, and imports of $1.5 trillion

Aggregate expenditure for the country is A) $5.5 trillion. B) $6.5 trillion. C) $6.0 trillion. D) $8.5 trillion. E) $7.0 trillion.

Energy drinks and granola bars are normal goods. When the price of energy drinks decreases, the income effect causes a

a. shift to a lower indifference curve, and the consumer buys fewer granola bars. b. shift to a higher indifference curve, and the consumer buys more granola bars. c. movement along the indifference curve, and the consumer buys fewer granola bars. d. movement along the indifference curve, and the consumer buys more granola bars.

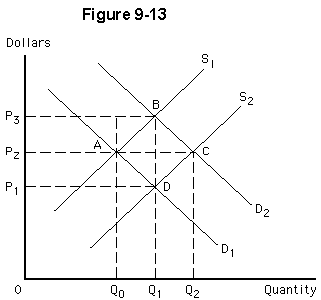

In Figure 9-13, a movement of equilibrium from point D to point C could be caused by a(n)

a.

decrease in supply from S2 to S1 in response to economic profits following a decrease in demand from D2 to D1

b.

increase in short-run supply from S1 to S2

c.

increase in supply from S1 to S2 in response to economic profits caused by an increase in demand from D1 to D2

d.

an increase in demand from D1 to D2 in the short run

Which of the following is a reason people choose to hold more cash?

a) Interest rates paid on savings and checking accounts at the bank rise dramatically. b) Consumers have more faith in the stability and safety of the financial system. c) Interest rates paid on savings and checking accounts at the bank are near zero. d) Holding cash becomes less convenient.