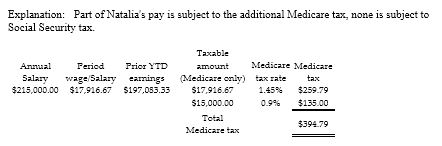

) Natalia is a full-time exempt employee who earns $215,000 annually, paid monthly. Her year-to-date pay as of November 30 is $197,083.33. How much will be withheld from Natalia for FICA taxes for the December 31 pay date? (Social Security maximum wage is $127,200. Do not round interim calculations, only round final answer to two decimal points.)

A) $292.04

B) $394.79

C) $1,370.63

D) $421.04

B) $394.79

You might also like to view...

The word property may refer to legal rights connected with an object, such as are found in the lease of a building.

Answer the following statement true (T) or false (F)

Which of the following statements is true regarding recent research on competence and psychological empowerment?

A. Competent people may feel resentful for bearing the burden of more work. B. Competent people cost organizations more than they are worth. C. Competent people get less accomplished than other people. D. Competent people tend to be assigned less tasks than other people.

Which of the following statements is incorrect?

a. The North American Industry Classification System (NAICS) was created jointly by the United States, Canada, and Mexico. b. For the NAICS, economic units with similar production processes are classified in the same industry, and the lines drawn between industries demarcate differences in production processes. c. NAICS provides enhanced industry comparability among the three NAFTA trading partners. d. NAICS divides the economy into twenty sectors. e. In most sectors, NAICS provides for compatibility at the industry (six-digit) level.

Which of the following are the basic steps in software reuse?

A) Abstraction, storage, and recontextualization B) Overloading and overriding C) Developing a business plan and an implementation plan D) Contextualization and generalization E) Purchasing new software and integrating it into existing systems