If a lender wants to earn a real interest rate of 3% and expects inflation to be 3%, he/she should charge a nominal interest rate that:

A. is at least 7%.

B. equals the real rate desired less expected inflation.

C. equals the real rate desired plus expected inflation.

D. is anything above 0%.

Answer: C

You might also like to view...

For 2016, the maximum taxable income for Social Security purposes is

A. $118,500. B. $97,500. C. unlimited. D. $51,125.

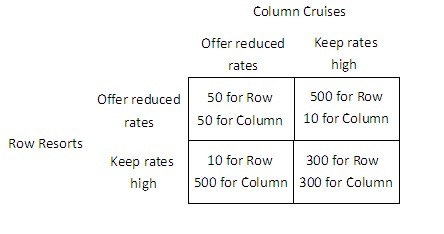

Refer to the figure below.  If Row Resorts offers reduced rates, then Column Cruises would receive the highest payoff if it:

If Row Resorts offers reduced rates, then Column Cruises would receive the highest payoff if it:

A. kept its rates high. B. offered reduced its rates. C. chose either strategy because it will have the same payoff in either case. D. entered into a cartel with Row Resorts and agreed to jointly reduce rates.

Cooling systems II Carl is the lead engineer on a smart HVAC cooling system that works with minimal energy and is voice activated. Given the revolutionary nature of the system, it took many failed tries to create a system that actually worked, a cost of

$30,000 . Now each unit sells for $6500 and it costs $5000 in raw materials and labor to produce. Carl receives an order for four new units for a customer, but when he takes the order to his manager, the manager is enraged and asks Carl why he wanted to produce something at a loss. What costs would the manager be looking at to come to this conclusion?

Inflation often bestows unearned income on

a. homeowners. b. lenders. c. creditors. d. fixed income receivers.