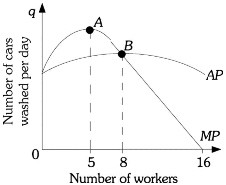

Refer to the information provided in Figure 7.5 below to answer the question(s) that follow.  Figure 7.5Refer to Figure 7.5. Increasing returns continue until the ________ worker is hired.

Figure 7.5Refer to Figure 7.5. Increasing returns continue until the ________ worker is hired.

A. first

B. fifth

C. eighth

D. sixteenth

Answer: B

You might also like to view...

If the price of lattes, a normal good you enjoy, falls, then

A) the income effect which causes you to increase your latte consumption outweighs the substitution effect which causes you to reduce your latte consumption, resulting in more lattes purchased. B) the income and substitution effects offset each other but the price effect leads you to buy more lattes. C) both the income and substitution effects lead you to buy more lattes. D) the substitution effect which causes you to increase your latte consumption outweighs the income effect which causes you to reduce your latte consumption, resulting in more lattes purchased.

The size of the effect of a given deposit of cash into a demand deposit account on the money supply is smaller:

a. the greater the fraction of money people want to hold as currency and the greater the fraction of deposits banks want to hold as excess reserves. b. the greater the fraction of money people want to hold as currency and the smaller the fraction of deposits banks want to hold as excess reserves. c. the smaller the fraction of money people want to hold as currency and the greater the fraction of deposits banks want to hold as excess reserves. d. the smaller the fraction of money people want to hold as currency and the smaller the fraction of deposits banks want to hold as excess reserves.

To compare the GDP of countries with different currencies, it is necessary to convert to a “common denominator” often referred to as _______.

a. purchasing power parity (PPP) b. exchange rate c. GDP per capita d. GDP

Interest income on municipal bonds

a. is subject to a portion of federal income tax. b. is taxable on amounts greater than $15,000 per year. c. is payable quarterly, at time of coupon redemption. d. is exempt from federal income tax.