The federal funds rate is

A. the interest rate on bonds issued by the federal government.

B. the interest rate paid on reserves held with the Fed.

C. the interest rate at which banks can borrow excess reserves from other banks.

D. none of these.

Answer: C

You might also like to view...

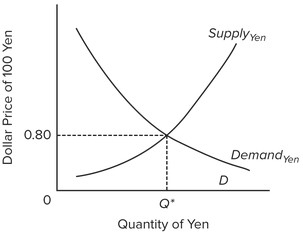

Use the following graph to answer the next question. Assume that Japan and the United States are engaged in a system of flexible exchange rates. An increase in the supply of yen will result in a(n) ________.

Assume that Japan and the United States are engaged in a system of flexible exchange rates. An increase in the supply of yen will result in a(n) ________.

A. increase in the dollar price of yen B. appreciation of the U.S. dollar C. depreciation of the U.S. dollar D. appreciation of the yen

Many individuals without health insurance receive "free" care. What are the sources of most of the care they receive?

a. Public hospitals and clinics. b. Private, not-for-profit hospitals. c. Private, for-profit hospitals. d. Multi-specialty physicians' practices. e. Solo practitioners and their associates.

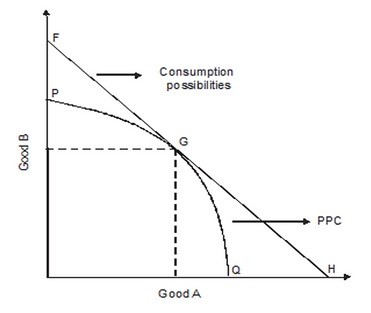

Refer to the following graph. If this country is producing between point P and G, it will gain by ________ its production of good A and importing more ________.

If this country is producing between point P and G, it will gain by ________ its production of good A and importing more ________.

A. decreasing; good A B. decreasing; good B C. increasing; good B D. increasing; good A

The multiple by which total deposits can increase for every dollar increase in reserves is the

A. deposit insurance limit. B. required reserve ratio. C. money multiplier. D. bank's line of credit.