Suppose that the free market exchange rate for the dollar is 115 yen, but the U.S. and Japanese governments want it to be 120 yen/dollar. What can the governments do? Illustrate your answer with a graph

What will be an ideal response?

As is shown in the graph, the initial demand and supply for the dollar intersect at an exchange rate of 115 yen/dollar. In order to raise the price of the dollar, the governments need to increase the demand for the dollar (shown in the graph as a shift in the demand curve). They would do this by selling yen for dollars until the exchange rate rises to the desired level of 120 yen/dollar.

You might also like to view...

To increase gas mileage, automobile manufacturers make cars small and light. Large cars absorb more of the impact of an accident than small cars but yield lower gas mileage

These facts suggest that a positive relationship exists between safety and gas mileage. Indicate whether the statement is true or false

If a firm is experiencing constant returns to scale

a. long-run average total cost neither rises nor falls as production increases b. average fixed cost is zero c. the increase in average variable cost is exactly offset by a decrease in average fixed cost d. the decrease in average variable cost is exactly offset by an increase in average fixed cost e. long-run average total cost is zero.

If the government wanted to encourage home? ownership, it? could:

A. make mortgage interest tax deductible. B. add a? 10% surcharge on every home purchase. C. tax homeowners based on asset values. D. None of the above.

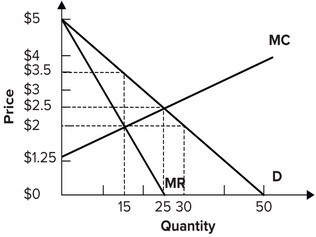

Refer to the graph shown. If the monopoly firm maximizes profit, it will produce:

A. 25 units of output and charge a price of $2.50 per unit. B. 30 units of output and charge a price of $2.00 per unit. C. 15 units of output and charge a price of $3.50 per unit. D. 15 units of output and charge a price of $2.00 per unit.