Economists regard expenditures on education as investments because:

A. they are subject to tax deductions at the same rate as are expenditures on machinery and

equipment.

B. education is economically beneficial at the same time it is being acquired.

C. such expenditures are current costs that are intended to enhance future earnings.

D. they differ from expenditures on health and worker mobility.

Answer: C

You might also like to view...

If short-run equilibrium output equals 20,000 and potential output (Y*) equals 25,000, then this economy has a(n) ________ gap that can be closed by ________.

A. expansionary; increasing government purchases B. expansionary; increasing transfer payments C. recessionary; increasing taxes D. recessionary; increasing government purchases

A streetlight is a

a. private good. b. club good. c. common resource. d. public good.

A small country is considering imposing a tariff on imported wine at the rate of $5 per bottle. Economists have estimated the following based on this tariff amount: World price of wine (free trade):$20 per bottleDomestic production (free trade):500,000 bottlesDomestic production (after tariff):600,000 bottlesDomestic consumption (free trade):750,000 bottlesDomestic consumption (after tariff):650,000 bottles The consumption effect of the tariff on wine is worth about

A. $3.5 million. B. $2.75 million. C. $500,000. D. $250,000.

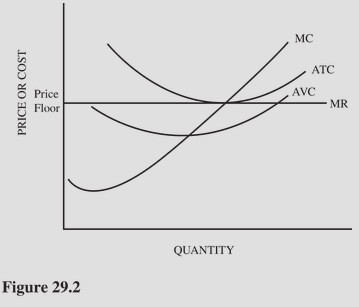

Refer to Figure 29.2 for Farmer Smith with a price floor set above the market price. Assume the price support is located at the minimum point on the farmer's ATC curve. If this support is eliminated, all of the following will result except

Refer to Figure 29.2 for Farmer Smith with a price floor set above the market price. Assume the price support is located at the minimum point on the farmer's ATC curve. If this support is eliminated, all of the following will result except

A. The rate of return on invested capital will increase. B. Farmers will begin to lose money as the price returns to equilibrium. C. Fewer resources will be allocated to this market. D. Some farmers will leave the industry.