Which of the following taxes is most likely to be regressive?

A. General sales taxes

B. Personal income taxes

C. Corporate income taxes

D. Estate taxes

Answer: A

You might also like to view...

If the Fed increases the quantity of money, then

A) aggregate demand increases and the AD curve shifts rightward. B) the quantity of real GDP demanded decreases and there is a movement up along the AD curve. C) both the aggregate demand curve and the aggregate supply curve shift leftward. D) aggregate demand decreases and the AD curve shifts leftward. E) the quantity of real GDP demanded increases and there is a movement down along the AD curve.

Gas and Coal Utility companies can use a mix of plants different energy sources to produce electricity, mainly these are coal fired plants but increasingly they relying on gas turbines. Technological improvements in hydraulic fracturing, or "fracking," have decreased the cost of extracting smaller pockets of natural gas. What affect does fracking have on supply and demand for coal?

Monetary policy under a fixed exchange-rate regime will be

A. more effective than fiscal policy. B. more powerful with high capital mobility than with low capital mobility. C. constrained and relatively ineffective. D. likely to cause large and persistent deficits.

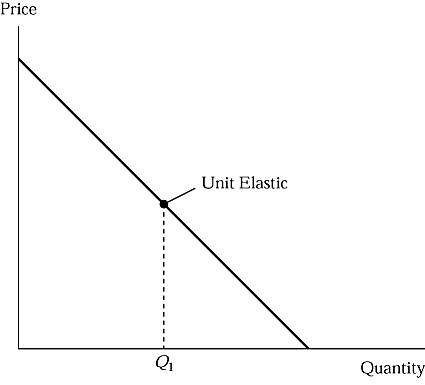

In Figure 4.2, at quantities at Q1:

In Figure 4.2, at quantities at Q1:

A. price and total revenue are unrelated. B. total revenue is maximized. C. price elasticity equals 1. D. All of these