Fraud in factum:

A) occurs when a person is persuaded to execute an instrument because of fraudulent statements

B) occurs when a person signs an instrument as a result of being fraudulently deceived regarding essential terms.

C) is not a universal defense.

D) cannot be raised against a holder in due course.

B

You might also like to view...

Types of Audit Opinions Subsequent to the date of the financial statements, as part of post-balance sheet date audit procedures, a CPA learned that a recent fire caused significant damage to one of the client's two manufacturing facilities. However, the

loss will not be reimbursed by insurance. Newspapers in the area describe the event in detail and the event is widely known. The financial statements and related notes as prepared by the client did not disclose the fire loss. REQUIRED: Which type of audit report would you suggest be issued this year and why?

"Do you think Coca-Cola is a tasty and refreshing soft drink?" is an example of a ________

A) structured question B) dichotomous question C) double-barreled question D) branching question

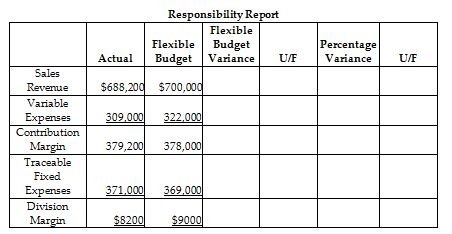

Katsu, Inc. has a small car division that operates as a profit center. Below is a partially completed responsibility report for the first quarter.

Compute the percentage variance for the flexible budget variance for sales revenue. (Round your answer to two decimal places.)

A) 1.69% F

B) 1.69% U

C) 4.04% U

D) 4.04% F

On January 2, 2010, McGowan Corporation issued 20-year bonds payable with a face value of $300,000 and a face interest rate of 8 percent. The bonds were issued to yield a market interest rate of 9 percent. Interest is payable annually on January 2 . In calculating the present value of the bond issue of January 2, 2010, the

a. 9 percent rate will be used to calculate the present value of the face amount and the 8 percent rate will be used to calculate the present value of the periodic interest payments. b. 9 percent rate will be used to calculate the present value of the face amount and the present value of the periodic interest payments. c. 8 percent rate will be used to calculate the present value of the face amount and the present value of the periodic interest payments. d. 8 percent rate will be used to calculate the present value of the face amount and the 9 percent rate will be used to calculate the present value of the periodic interest payments.