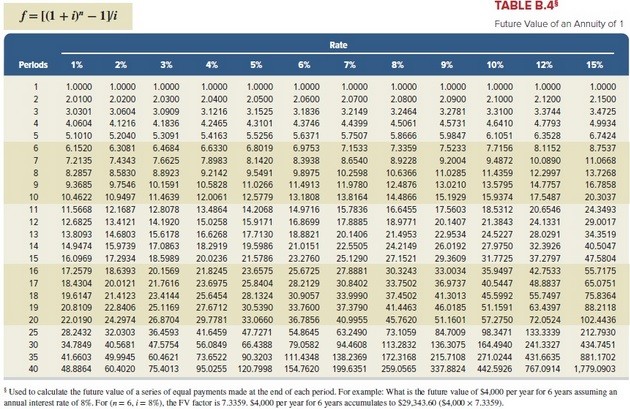

An individual is planning to set-up an education fund for her daughter. She plans to invest $7200 annually at the end of each year. She expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 8%. What will be the

An individual is planning to set-up an education fund for her daughter. She plans to invest $7200 annually at the end of each year. She expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 8%. What will be the

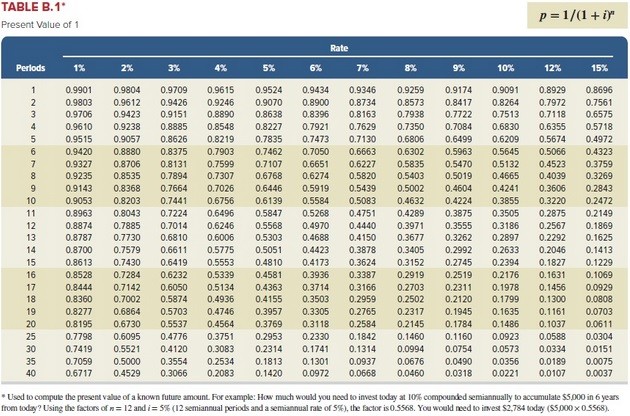

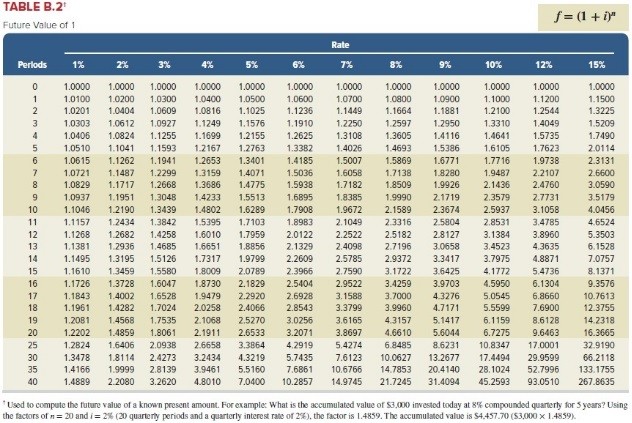

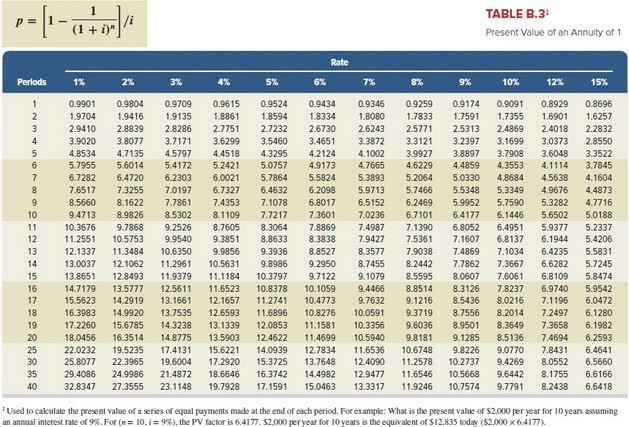

total value of the fund at the end of 9 years? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

A. $89,910.72

B. $46,933.92

C. $69,984.00

D. $129,600.00

E. $51,840.00

Answer: A

You might also like to view...

The ________ Act establishes a national fraud alert system so that consumers have a timely way to guard their credit.

What will be an ideal response?

Which of the following statements is false regarding the process of preparing a sales forecast?

A) It usually starts with last year's level of sales. B) General economic trends are often considered. C) Since it involves estimates of future events, accuracy is of little importance. D) The larger the size and complexity of an organization, the more complex their sales forecasting system will be.

GIF and PDF formats are:

A) impossible to change. B) used to change documents. C) not easily changed. D) none of the above.

An appropriate collateral for a secured short-term loan is ________

A) fixed assets B) accounts receivables C) common stock in a privately-held corporation D) bank over-draft