The example of an inflationary gap in 2006–2007 suggested that the economy adjusts

A. rapidly to inflationary gaps by lowering prices.

B. rapidly to inflationary gaps by raising prices.

C. slowly to inflationary gaps by lowering prices.

D. slowly to inflationary gaps by increasing inflation.

Answer: D

You might also like to view...

If the cost of the CPI market basket at current period prices is $1000 and the cost of the CPI market basket at base period prices is $250, the CPI is

A) 2.50. B) 400. C) 250. D) 100. E) 4.0.

The supply of loanable funds reflects the willingness of

a. businesses to borrow loanable funds for new capital at various interest rates b. consumers to spend loanable funds for items, such as new cars, at various interest rates c. savers to provide loanable funds to the loanable funds market at various interest rates d. firms to provide the funds, which is why production occurs in the first place e. people to invest in business enterprise, if the price is right (meaning if the interest rate is right)

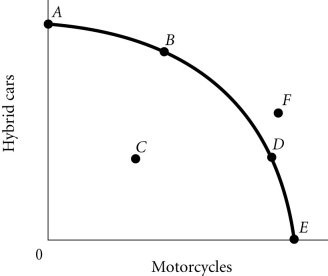

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4Refer to Figure 2.4. The economy moves from Point A to Point D. This could be explained by

Figure 2.4Refer to Figure 2.4. The economy moves from Point A to Point D. This could be explained by

A. an increase in economic growth. B. a change in society's preferences for motorcycles versus hybrid cars. C. a reduction in unemployment. D. an improvement in technology.

In recent years, the United States has had large:

A. current account surpluses. B. current account deficits. C. balance of trade surpluses. D. balance of payments surpluses.