Suppose there is an increase in the U.S. interest rate relative to European interest rates. How does this affect U.S. investors?

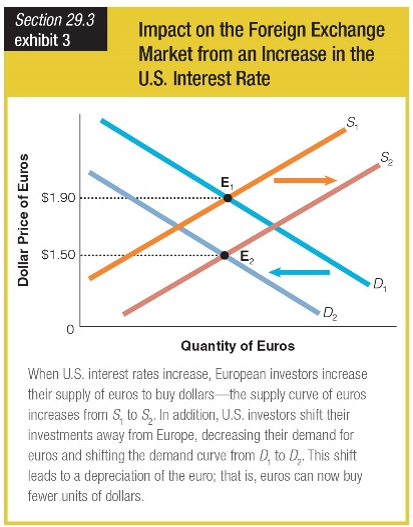

a. U.S. investors decrease their demand for euros relative to their demand for dollars, shifting D1 to D2.

b. U.S. investors shift their investments to Europe, shifting the demand curve from D1 to D2.

c. U.S. investors shift their investments to Europe, shifting the demand curve from D2 to D1.

d. U.S. investors increase their demand for euros relative to their demand for dollars, shifting D2 to D1.

a. U.S. investors decrease their demand for euros relative to their demand for dollars, shifting D1 to D2.

You might also like to view...

A commodity speculator who thinks next fall's corn harvest will actually be much larger than most people now anticipate will want to

A) buy corn now for sale in September. B) buy September corn futures. C) buy land suitable for growing corn. D) sell September corn futures. E) sell corn in September from stocks accumulated between now and September.

Describe the technology transfer benefit of capital flows and the political power cost of large capital flows into low-income countries

What will be an ideal response?

Exports from and imports to the U.S. were important to growth in the U.S. between 1790 and 1860 because

(a) exports to other countries expanded the market base for U.S. manufacturing goods. (b) they supported the U.S. economy during a time in which it used more agricultural goods and crude materials than it produced. (c) they helped the U.S. and its trading partners gain wealth through international trade of those goods and services in which each produced at a comparative advantage. (d) they contributed to all of the above.

If consumption is $8 billion, investments is $4 billion, government purchases are $2 billion, imports are $1 billion, and exports are $2 billion, GDP must equal:

A. $16 billion. B. $17 billion. C. $15 billion. D. $14 billion.