Other things the same, people in the U.S. would want to save more if the real interest rate in the U.S

a. fell. The increased saving would increase the quantity of loanable funds demanded.

b. fell. The increased saving would increase the quantity of loanable funds supplied.

c. rose. The increased saving would increase the quantity of loanable funds demanded.

d. rose. The increased saving would increase the quantity of loanable funds supplied.

d

You might also like to view...

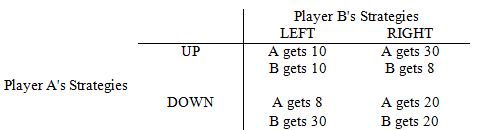

Refer to Game Matrix IV. The Nash Equilibrium for the game is

Game Matrix IV

The following questions refer to the game matrix below.

Player A can play the strategies UP and DOWN and Player B can play the strategies LEFT and RIGHT.

a. UP, LEFT

b. UP, RIGHT

c. DOWN, LEFT

d. DOWN, RIGHT

During the Great Depression, one reason the Federal Reserve did not respond forcefully was the "free gold problem," which refers to the idea that ___

a. gold was fleeing Nazi Germany, thus undermining the Fed's attempt to control the money supply b. gold was essentially free because people had excess supplies of currency that could be converted into gold c. the Fed claimed that almost all its gold was tied up by reserve requirements (there was little free so it could not increase the money supply) d. gold was essentially free because silver, which existed in abundance, could be converted into gold at the fixed rate of 16:1

Which of the following statements about the income effect of a price change is NOT true?

A. It affects consumption by removing compensation. B. It always involves a parallel shift in the budget line. C. It isolates the influence of a change in relative prices. D. It reflects the fact that a price change affects a consumer's purchasing power.

How do modern economies experience ongoing inflation when achieving economic growth?

What will be an ideal response?