Suppose a bond has a coupon of $75, face value of $1000, and current price of $1100. What is the coupon rate? What is its current yield? Report a percentage with two decimal places

What will be an ideal response?

The coupon rate is $75/$1000 = 7.50%. The current yield is $75/$1100 = 6.82%.

You might also like to view...

Economic rent is:

A. the difference between the payment made to the owner of a factor of production and the owner's reservation price. B. sometimes higher and sometimes lower than the owner's reservation price. C. the amount people pay for an apartment in a perfectly competitive market. D. the payment made to the owner of a factor of production, which is usually equal to the owner's reservation price.

Economists of the rational expectations school: a. have no confidence in the ability of workers and firms to observe and react to economic events

b. believe workers and firms behave the same regardless of what the Fed does. c. have great faith in the ability of monetary policy makers to maintain a full employment economy with stable prices. d. believe that effective monetary policy can shift the potential level of output to the right. e. believe workers and firms make decisions based on what they think monetary policy will be in the future.

When a consumer experiences a price increase for an inferior good, if the income effect is

a. greater than the substitution effect, the demand curve will be downward sloping. b. greater than the substitution effect, the demand curve will be upward sloping. c. less than the substitution effect, the demand curve will be upward sloping. d. less than the substitution effect but the substitution effect is positive, the demand curve will be upward sloping.

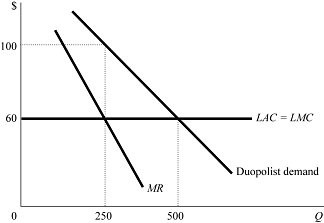

Figure 8.8 shows demand, marginal revenue, and costs of an individual duopolist. If the two duopolists have the same costs and split the market equally, each profit-maximizing duopolist will produce and sell a quantity of ________.

Figure 8.8 shows demand, marginal revenue, and costs of an individual duopolist. If the two duopolists have the same costs and split the market equally, each profit-maximizing duopolist will produce and sell a quantity of ________.

A. 1,000 units B. 500 units C. 250 units D. 125 units