Everything else fundamentally remaining unchanged, the monetary approach predicts that a 5 percent cut in the money supply by the Fed will result in

A. an increase in foreign investments by the Americans.

B. an appreciation of the U.S. dollar vis-à-vis other currencies.

C. inflation in the U.S. economy.

D. a decrease in the market rate of interest in the United States.

Answer: B

You might also like to view...

Ongoing inflation means the Fed must respond to

a. an upward-shifting AS curve b. a downward-shifting AS curve c. changing interest rate targets d. a depression e. a lower real interest rate

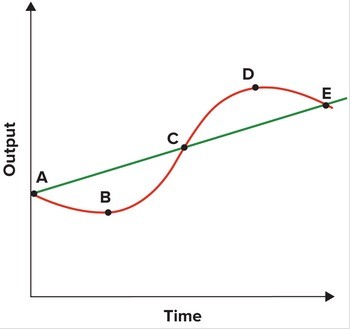

Refer to the graph shown. A movement from points A to B represents a(n):

A movement from points A to B represents a(n):

A. upturn. B. downturn. C. trough. D. peak.

Why should a firm not produce more than the rate of output at which marginal revenue equals marginal cost?

What will be an ideal response?

Which of the following statements about the average total cost curve is false?

A. The marginal cost curve crosses the average total cost curve at the point at which average total cost is minimized. B. It is initially downward sloping because increases in quantity make the average fixed cost smaller. C. It eventually becomes upward sloping because the law of diminishing returns sets in. D. It is always downward sloping because the average fixed costs will always decrease as quantity increases.