Which of the following is true in the long run?

What will be an ideal response?

The actual price level and the expected price level are equal.

You might also like to view...

(i) How many videos does Spencer rent each year? How much consumer's surplus does Spencer receive from renting videos? (ii) Blockpopper's starts a "frequent viewers" club. For a membership fee of $35 per year, club members can rent as many videos as they wish at the discounted price of $2 per rental. Should Spencer join the "frequent viewers" club? If yes, how much surplus value would Spencer receive as a club member? If no, what membership fee would Spencer be willing to pay to join the club?

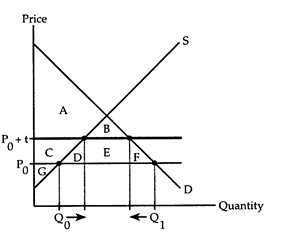

(i) The accompanying diagram shows the effects of a tariff. Initially, the price is P0, domestic firms produce Q0 units, and Q1 - Q0 units are imported from foreign firms. When the tariff is imposed, the price increases to P0 + t.

How does the tariff affect consumers' surplus and producers' surplus? How much tariff revenue is collected by the government? Does imposing the tariff cause the country's social gain to rise or fall?

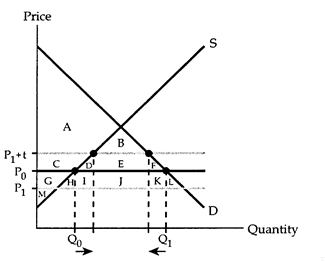

(ii) The situation in part i is known as the "small country" case-the country has no market power, so its tariff does not affect the world price P0. Now consider the "large country" case shown in the accompanying diagram-in this case, the country has market power, and the tariff (by reducing the demand for imports) causes the world price to fall from P0 to P1. So after the tariff is imposed, the domestic price is P1 + t.

How does the tariff affect consumers' surplus and producers' surplus in this situation? How much tariff revenue is collected by the government? When a "large country" imposes a tariff, will its social gain rise or fall?

If we observe that Jamie's budget constraint has moved outward, then we know for certain that

a. her income must have increased. b. she will be indifferent between goods X and Y. c. the price of one or both of the goods must have decreased. d. she can reach a higher indifference curve.

The marginal cost is the cost of ______.

a. inefficiency and waste while producing a good b. taxes levied on the production of a good c. producing all of the units of a good d. producing one more unit of a good.

The benefit from a good experienced by people who do not decide how much of the good to produce or consume is called a(n):

A. public benefit. B. private benefit. C. external benefit. D. consumption benefit.