What does the Herfindahl-Hirschman Index value near zero imply about the market?

A. Monopoly

B. Perfect competition

C. Monopolistic competition

D. Oligopoly

Answer: B

You might also like to view...

If, when the price falls, total revenue increases, demand is

A) elastic. B) inelastic. C) unit elastic. D) perfectly inelastic. E) None of the above answers is correct because total revenue always decreases when the price of the good falls.

Since the mid-1970s, the average U.S. tariff rate is

A) less than 5 percent. B) between 6 percent and 15 percent. C) between 16 percent and 25 percent. D) between 26 percent and 35 percent. E) larger than 36 percent.

Following mergers that raised the market shares of two airlines to 79 and 82 percent, respectively, of traffic in their hub cities, prices of service rose and the quantities of service fell, even though in most other markets, prices fell and quantities increased. The result suggests that

A. these markets were contestable. B. there was evidence of market power. C. oligopoly firms bought out their competitors. D. the market had no barriers to entry.

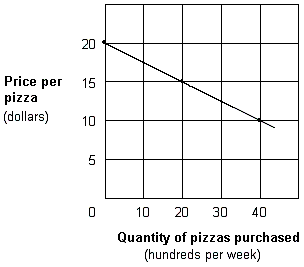

Exhibit 1A-8 Straight line relationship

A. direct. B. inverse. C. complex. D. independent.