Jamal earns $150,000 per year and Josephina earns $80,000 per year. If Jamal pays $15,000 in income taxes and Josephina pays $8,000 in income taxes, the income tax system would be

A. regressive.

B. proportional.

C. marginal.

D. progressive.

Answer: B

You might also like to view...

Firms are assumed to be price takers in a perfectly competitive market because

a. they are not allowed by law to charge any price other than the market price b. they must accept any price offered by consumers c. they earn high enough profits at the market price, so they do not want to hurt consumers by raising their prices d. each firm is too small to influence the market price e. there are too few buyers in the market to absorb price changes

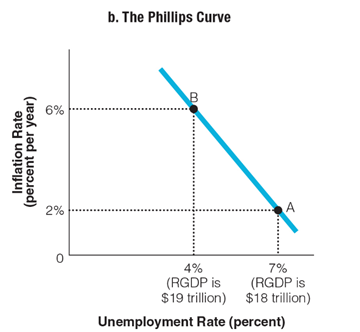

Based on the graph showing the Phillips curve, you would expect to see ______ at point A than at point B.

a. higher real wages

b. lower real wages

c. prices increasing faster

d. companies seeking more workers

"As the price of gasoline rises, the demand for gasoline will fall." That statement is

What will be an ideal response?

Personal saving is equal to:

A. Disposable income plus consumption B. Consumption minus disposable income C. Disposable income minus consumption D. Consumption divided by disposable income