Assume that the government proposes a negative income tax that calculates the taxes owed as follows: taxes owed equal 30% of income less 12,000 . A family that earns an income of $60,000 will

a. pay $6,000 in taxes.

b. receive an income subsidy of $6,000.

c. receive an income subsidy of $12,000.

d. have an after-tax income of $48,000.

a

You might also like to view...

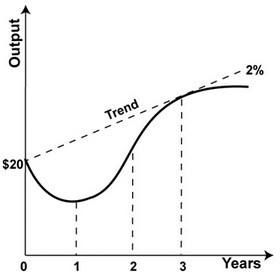

Refer to the graph. Economic output in year 0 is $20 billion. What is potential output in year 3?

A. $21.2 billion B. $20 billion C. $20.4 billion D. $20.8 billion

Assume individuals consider only the long run effects of changes in future macro variables when forming expectations of future output and future interest rates. Suppose individuals expect future government spending to increase. Given this information, individuals will expect

A) an increase in the expected future interest rate and no change in expected future output. B) an increase in the expected future interest rate and an increase in expected future output. C) an increase in the expected future interest rate and a reduction in expected future output. D) an increase in the expected future interest rate and an ambiguous effect on expected future output.

A nation’s currency is said to appreciate when exchange rates change so that a unit of its currency can buy more units of foreign currency.

Answer the following statement true (T) or false (F)

Why does the appreciation of a country's currency tend to decrease its price level?

A. Domestic buyers tend to substitute domestic products for imports. B. A currency appreciation makes a country's products more competitive in world markets, so exports rise. C. A currency appreciation makes imported inputs more expensive. D. A currency appreciation makes imported inputs less expensive.