Lower input prices in large firms might lead to:

A. upward-sloping marginal cost curves.

B. upward-sloping short-run average cost curves.

C. upward-sloping long-run average cost curves.

D. downward-sloping long-run average cost curves.

Answer: D

You might also like to view...

An asset-price bubble entails ________

A) increasing the value of one's assets to cover liability losses B) an increase in asset prices above their fundamental economic value C) reducing the number of participants in the underlying financial derivatives market D) an economic skins game

Appendix: A Dutch auction implies all of the following except

a. more than one unit sale available b. higher prices later in the auction c. identical expected seller revenue for common value items d. greater expected seller revenue in estate sales with risk-averse bidders

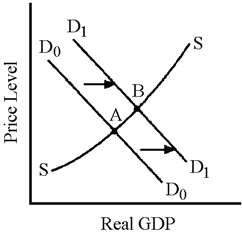

Figure 17-1

Which of the following is true about the economy depicted in Figure 17-1?

a.

It is experiencing supply-side inflation.

b.

Policy makers have chosen to fight inflation rather than unemployment.

c.

The increase in aggregate demand has increased prices but not real GDP.

d.

The slope of the aggregate supply curve embodies the trade-off between unemployment and inflation.

The average expected rate of return on most financial assets is the sum of the rates that compensate for:

A. nondiversifiable risk and time preference. B. diversifiable risk and time preference. C. nondiversifiable and diversifiable risk. D. nondiversifiable and diversifiable risk, and time preference.