A firm with two factories, one in Michigan and one in Texas, has decided that it should produce a total of 500 units of output in order to maximize profit. The firm is currently producing 200 units in the Michigan factory and 300 units in the Texas factory. At this allocation between plants, the last unit of output produced in Michigan added $5 to total cost, while the last unit of output produced in Texas added $3 to total cost. If the firm produces 201 units in Michigan and 299 units in Texas instead:

A. total cost will decrease $2

B. total cost will decrease $3

C. profit will increase $2

D. both a and b

E. none of the above

Answer: E

You might also like to view...

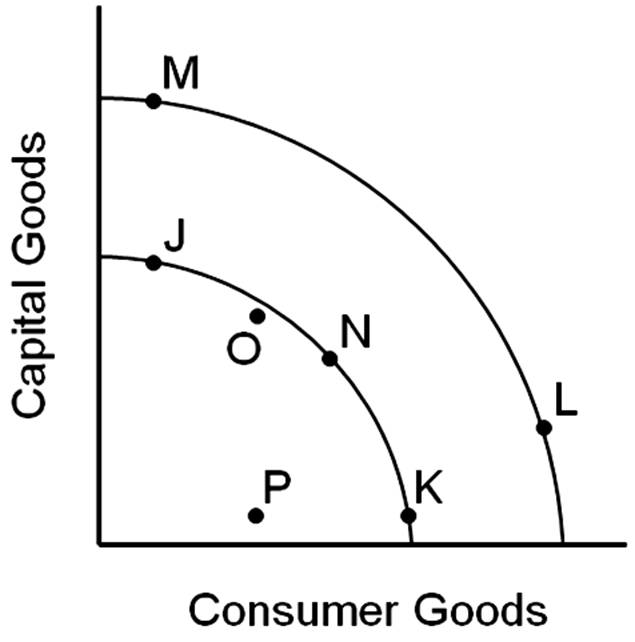

Which movement between two points represents economic growth?

A. J to K

B. K to L

C. L to M

D. M to N

In the liquidity preference framework, a one-time increase in the money supply results in a price level effect. The maximum impact of the price level effect on interest rates occurs

A) at the moment the price level hits its peak (stops rising) because both the price level and expected inflation effects are at work. B) immediately after the price level begins to rise, because both the price level and expected inflation effects are at work. C) at the moment the expected inflation rate hits its peak. D) at the moment the inflation rate hits it peak.

Refer to Figure 9.7. Because of the policy, consumer surplus fell by

A) $10. B) $20. C) $12,500. D) $25,000. E) $45,000.

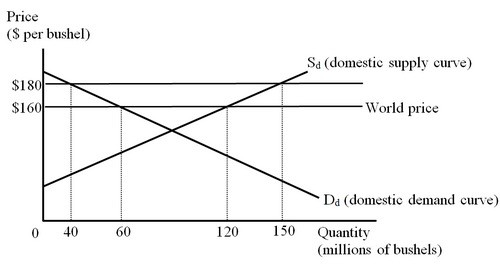

The figure below represents the domestic market for wheat in a small country. Imports of wheat are prohibited. At a world price of $160 per bushel, the country produced ________ bushels of wheat and exported ________ bushels of wheat.

At a world price of $160 per bushel, the country produced ________ bushels of wheat and exported ________ bushels of wheat.

A. 120; 80 B. 60; 120 C. 120; 60 D. 150; 120