Assume a simplified banking system in which all banks are subject to a uniform reserve requirement of 20 percent and checkable deposits are the only from of money. A bank that received a new checkable deposit of $10,000 would be able to extend new loans up to a maximum of:

A. $2,000.

B. $8,000.

C. $9,000.

D. $10,000.

Answer: B

You might also like to view...

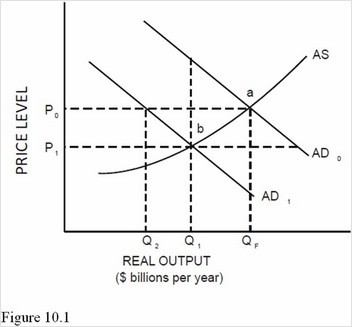

In Figure 10.1, which of the following could cause a shift from AD0 to AD1, ceteris paribus?

In Figure 10.1, which of the following could cause a shift from AD0 to AD1, ceteris paribus?

A. An increase in consumer confidence. B. An increase in consumption. C. A decrease in investment. D. An increase in exports.

There is asymmetric information in the used car market because sellers cannot distinguish between lemons (low-quality) and plums (high-quality), but buyers can.

Answer the following statement true (T) or false (F)

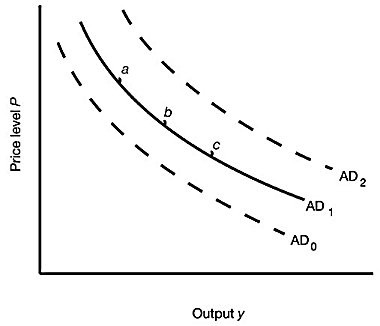

Suppose that we are currently at point b in Figure 14.1. An increase in the price level will result in a:

Suppose that we are currently at point b in Figure 14.1. An increase in the price level will result in a:

A. shift in the AD curve from AD1 to AD2. B. shift in the AD curve from AD1 to AD0. C. movement from point b to point a. D. movement from point b to point c.

A situation in which one firm's actions with respect to price, quality, advertising and related changes may be strategically countered by the reactions of one or more other firms in the industry is known as

A) strategic dependence. B) economies of scale. C) the concentration ratio. D) barriers to entry.