Suppose that there are two types of cars, good and bad. The qualities of cars are not observable but are known to the sellers. Risk-neutral buyers and sellers have their own valuation of these two types of cars as follows:Types of CarsBuyer's ValuationSeller's ValuationGood (50% probability)5,0004,500Bad (50% probability)3,0002,500When buyers do not observe the quality, what happens in the market?

A. Both good and bad cars are traded.

B. Neither good nor bad cars are traded.

C. Only good cars are traded.

D. Only bad cars are traded.

Answer: D

You might also like to view...

The Celler-Kefauver Act of 1950 amended the:

a. Sherman Antitrust Act. b. Clayton Act. c. Federal Trade Commission Act. d. Robinson-Patman Act.

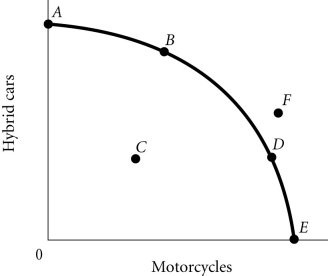

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, as the economy moves from Point E to Point A, the opportunity cost of hybrid cars, measured in terms of motorcycles

Figure 2.4According to Figure 2.4, as the economy moves from Point E to Point A, the opportunity cost of hybrid cars, measured in terms of motorcycles

A. increases. B. initially increases, then decreases. C. decreases. D. remains constant.

You and your brother are splitting a piece of cake. You cut it into two pieces and your brother selects his piece first. Thus, you cut it into two equally sized pieces. This is an example of

A. a public good. B. utilitarian justice. C. Rawlsian justice. D. communism.

The discount rate is

A. the interest rate commercial banks charge their new customers. B. the interest rate the Fed charges commercial banks for borrowing funds. C. the interest rate commercial banks charge each other for borrowing funds. D. the interest rate commercial banks charge their most creditworthy customers.