According to agency theory, a financial crisis results from ________ that disrupts the flow of funds from lender-savers to borrower-spenders

A) an increase in asymmetric information

B) a macroeconomic shock

C) the existence of asymmetric information

D) a decrease in saving

A

You might also like to view...

If the nominal interest rate on a one-year loan was 7%, the actual inflation rate over the year was 3% and the expected inflation rate over the year was 2.5%, then the expected real interest rate equals

A) 4.5%. B) 4.0%. C) 3.75%. D) 3.5%.

?Exhibit 10A-2 Macro AD-AS Model

A. ?potential real GDP output for this economy. B. that the economy is experiencing zero inflation. C. ?that the economy is experiencing a recessionary gap. D. ?the level of real GDP where the unemployment rate is zero.

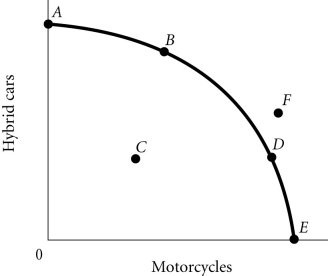

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point A necessarily represents

Figure 2.4According to Figure 2.4, Point A necessarily represents

A. only hybrid cars being produced. B. an unattainable production point. C. what society wants. D. the economy's optimal production point.

If $.80 U.S. = $1.00 Canadian,

A. a U.S. nickel is worth four Canadian cents. B. a U.S. quarter is worth 40 Canadian cents. C. 40 Canadian cents are worth 50 U.S. cents. D. $.04 U.S. is worth 5 Canadian cents.