A performance report for variable overhead reveals:

A) the aggregate variable overhead spending and efficiency variances

B) the volume and spending variances

C) the spending and efficiency variances for each variable overhead item

D) both the aggregate variable overhead spending and efficiency variances and the spending and efficiency variances for each variable overhead item

E) both the volume and spending variances and the spending and efficiency variances for each variable overhead item

D

You might also like to view...

Which of the following is NOT as a risk associated with ERP implementation?

a. A drop in firm performance after implementation because the firm looks and works differently than it did while using a legacy system. b. Implementing companies have found that staff members, employed by ERP consulting firms, do not have sufficient experience in implementing new systems. c. Implementing firms fail to select systems that properly support their business activities. d. The selected system does not adequately meet the adopting firm's economic growth. e. ERP's are too large, complex, and generic for them to be well integrated into most company cultures.

In the 1950s and 1960s, psychologists examining groups primarily focused on studying ____.

a. Group dynamics b. Encounter groups c. Conformity and helping behavior d. Self-awareness e. Education

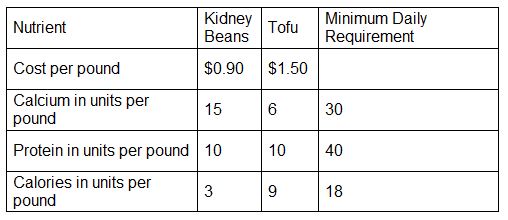

At the optimum solution, what is the total number of units of protein included in the diet?

A school is trying to determine a nutritional diet to feed its students. The school would like to offer some combination of milk and beans. The school’s objective is to minimize cost, subject to meeting the minimum nutritional requirements of protein, calcium, and calories. The cost and nutritional content of each food, along with the minimum nutritional requirements are shown here.

A. 30

B. 40

C. 51

D. 18

What is a credit boom?

A) An explosion in a credit cycle, which can increase or decrease lending in the short-run B) Essentially a lending spree on the part of banks and other financial institutions C) When credit card receivables rise due to low initial interest rates D) The signal of the end of a credit spree, with credit contracting rapidly