Suppose you buy a house for $250,000. One year later, the market price for the house has fallen to $200,000. What is the return on your investment in the house if you made a down payment of 10 percent and took out a mortgage loan for the other 90 percent?

What will be an ideal response?

The market price has fallen by $50,000, so with a 10 percent down payment, your return on investment is -$50,000 divided by the 10 percent down payment of $25,000. or -50,000/ $25,000 = -2, which means you lost 200 percent.

You might also like to view...

Keynes's liquidity preference theory indicates that the demand for money is ________ related to ________

A) negatively; interest rates B) positively; interest rates C) negatively; income D) negatively; wealth

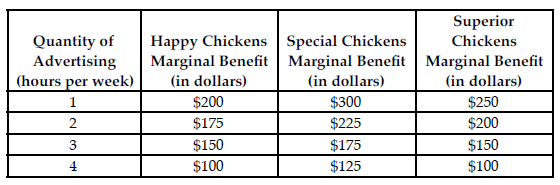

Refer to the table below. If the cost per unit of advertising is constant at $600, what is the level of advertising per week that maximizes the industry joint profit?

Suppose the egg industry is made up of only the three farms above; Happy Chickens, Special Chickens, and Superior Chickens.

A) 4

B) 2

C) 1

D) 3

An increase in the actual inflation rate is represented by a

A) movement up and along a given Phillips curve. B) movement down and along a given Phillips curve. C) leftward shift in the Phillips curve. D) rightward shift in the Phillips curve.

DVD players and DVDs are:

A. complementary goods. B. inferior goods. C. independent goods. D. substitute goods.