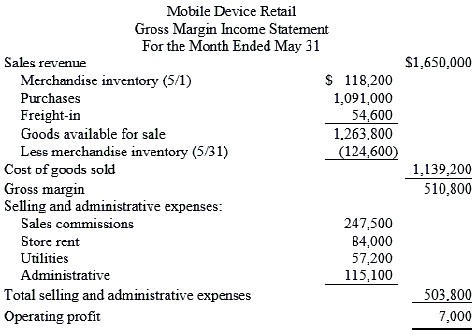

Mobile Device Retail has collected the following information for May: Sales revenue$1,650,000Store rent 84,000Utilities 57,200Sales commissions 247,500Merchandise inventory, May 1 118,200Merchandise inventory, May 31 124,600Freight-in 54,600Administrative costs 115,100Merchandise purchases 1,091,000Required:Prepare a gross margin income statement for the month of May.

What will be an ideal response?

You might also like to view...

The preemptive message strategy works best for a firm that is clearly the brand leader and is the dominant company in the industry

Indicate whether the statement is true or false

Alexis manages a clothing store in the mall. They were understaffed, and she thought she would have to work all day and help close the store that evening until a young man came in for an application around noon. Alexis told him he could have the job if he could come back at 4 p.m. to begin work. Here, Alexis was engaged in

A. relaxed avoidance. B. confirmation bias. C. satisficing. D. heuristics. E. analytics.

Traditional channels of distribution

A. may involve little or no cooperation among channel members. B. are usually controlled through strong legal contracts. C. are usually preferred to other distribution arrangements. D. do not perform bulk-breaking activities. E. are easier to control than corporate channel systems.

Island Company has 1,000,000 shares of common stock authorized with a par value of $3 per share of which 600,000 shares are outstanding. Island authorized a stock dividend when the market value was $8 per share, entitling its stockholders to one additional share for each share held. The par value of the stock was not changed. Assuming the declaration is not recorded separately, what entry, if

any, should Island make to record distribution of the stock dividend? a. Retained Earnings........... 4,800,000 Common Stock.............. 1,800,000 Gain on Stock Dividends... 3,000,000 b. Retained Earnings........... 1,800,000 Common Stock.............. 1,800,000 c. Retained Earnings........... 4,800,000 Common Stock.............. 1,800,000 Paid-In Capital from Stock Dividends 3,000,000 d. Memorandum entry noting the number of additional shares issued as a dividend