Which of the following formulas is most representative of a negative income tax proposal?

a. Taxes Owed = (1/4 of Income) $2

b. Taxes Owed = (1/2 of Income) 3/4

c. Taxes Owed = (1/2 of Income) + $10,000

d. Taxes Owed = (1/3 of Income) - $10,000

d

You might also like to view...

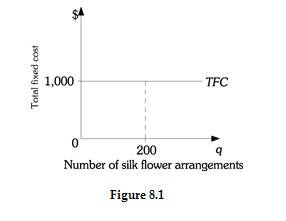

Refer to Figure 8.1 above. The total fixed costs for Cyndy's Floral Arrangements are $1,000. If Cyndy's Floral Arrangements produces 200 silk flower arrangements, the average fixed costs are A) $.20. B) $5. C) $20. D) $200.

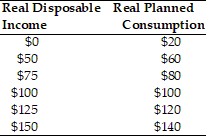

Use the above table. The autonomous consumption in this table is

Use the above table. The autonomous consumption in this table is

A. $140. B. $20. C. $50. D. $0.

Refer to the table shown that depicts a third-party payer market. What is the quantity demanded if a $1 co-pay is established?PriceQuantity DemandedQuantity Supplied$01,2000$1600150$2300300$30450$40600$50750$60900$701,050

A. 300 B. 0 C. 900 D. 600

If price is $5, marginal cost is $5, average total cost is $3, and the quantity produced is 150 units, then the perfectly competitive firm is

A) not maximizing economic profit. B) earning $2 in economic profits and is maximizing economic profits. C) earning $150 in economic profits and is not maximizing economic profits. D) earning $300 in economic profits and is maximizing economic profits.