You have a bond that you can redeem for $10,000 one year from now. The interest rate is 3 percent (0.03) per year. How much is the bond worth today?

a. $9,090.91

b. $10,000.00

c. $8,264.46

d. $9,708.74

e. $9,000.00

D

You might also like to view...

Borrowing to pay for long-lived capital expenditures makes sense as

A) the benefits are received in the current year so the burden of paying for them should be spread over many years. B) the benefits are received in the current year so the burden of paying for them should be paid in the current year. C) the benefits are received over many years so the burden of paying for them should be spread over many years. D) the benefits are received over many years so the burden of paying for them should be paid in the current year.

Everything else held constant, an increase in the excess reserves ratio causes the M1 money multiplier to ________ and the money supply to ________

A) decrease; increase B) increase; increase C) decrease; decrease D) increase; decrease

In general, countries with lower rates of growth of labor productivity have

a. lower levels of productivity. b. higher levels of productivity. c. lower levels of educational attainment. d. higher levels of natural resource endowments.

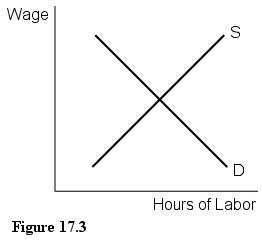

In Figure 17.3, a decrease in the demand for labor will cause the equilibrium:

In Figure 17.3, a decrease in the demand for labor will cause the equilibrium:

A. wage and hours of labor used to increase. B. wage and hours of labor used to decrease. C. wage to increase and hours of labor used to decrease. D. wage to decrease and hours of labor used to increase.