Suppose there is a 30% chance that an oil spill will occur in an area and the economic damage of the potential spill is $1 million. What is the expected value associated with the spill?

a. $3,000,000

b. $1,000,000

c. $300,000

d. $30,000

e. $3,000

Ans: c. $300,000

You might also like to view...

If the equilibrium exchange rate exceeds the par exchange rate in the market for pounds, the pound is overvalued

Indicate whether the statement is true or false

What is a fixed exchange rate and how is its value fixed?

What will be an ideal response?

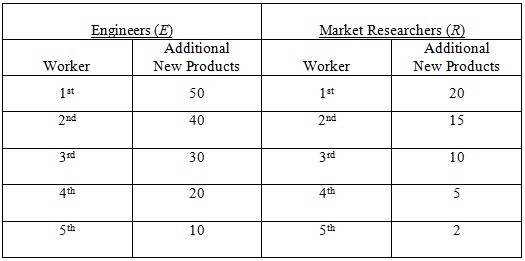

A manager in charge of new product development can hire engineers and market researchers. The annual salary of an engineer is $40,000, while a market researcher receives $20,000. The marginal contributions of engineers and market researchers are: Based on the above information, how should the manager with an annual budget of $160,000, allocate this budget in order to maximize the number of new products developed?

Based on the above information, how should the manager with an annual budget of $160,000, allocate this budget in order to maximize the number of new products developed?

A. Hire 4 engineers and 1 market researcher. B. Hire 4 engineers and 3 market researchers. C. Hire 2 engineers and 1 market researcher. D. Hire 3 engineers and 2 market researchers.

Costs that have already been incurred, and which cannot be recovered, are known as

A) short-run fixed costs. B) implicit costs. C) unavoidable costs. D) sunk costs.