A small industrial contractor purchased a warehouse building for storing equipment and materials that are not immediately needed at construction job sites. The cost of the building was $100,000 and the contractor has just made an agreement with the seller to finance the purchase over a 5-year period. The agreement states that monthly payments will be made based on a 30-year repayment schedule of interest on the unrecovered balance of the principal; however, the total remaining balance of principal and interest at the end of year 5 must be paid in a lump-sum “balloon” payment. What is the size of the balloon payment, if the interest rate on the loan is 0.5% per month?

What will be an ideal response?

Monthly payment = 100,000(A/P,0.5%,360)

= 100,000(0.00600)

= $600

Balloon payment = 100,000(F/P,0.5%,60) – 600(F/A,0.5%,60)

= 100,000(1.3489) – 600(69.7700)

= $93,028

Trades & Technology

You might also like to view...

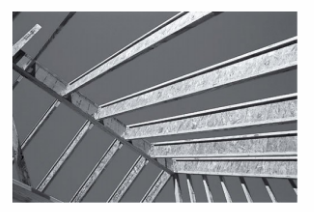

What type of engineered lumber product is shown in the image?

a. Glulam beams

b. Wood I-beams

c. LVL joists

d. Structural HDO rafters

Trades & Technology

Citrus fruits are high in vitamin _____

A) A B) C C) D D) B

Trades & Technology

Americans prefer to buy their food ____________________ to eat

Fill in the blank(s) with correct word

Trades & Technology

A TI 36X calculator is set in octal mode. The calculator display shows 116. If the calculator is set to hexadecimal mode, what would the display show?

Fill in the blank(s) with the appropriate word(s).

Trades & Technology