Antitrust policy has no relationship to socially desirable market performance

a. True

b. False

B

You might also like to view...

The interest rate is the price borrowers pay to borrow money. Key interest rates are controlled by the Federal Reserve System. If the Federal Reserve acts to reduce interest rates, economists would expect the demand for money to

A. increase. B. decrease. C. not change. D. Uncertain-economic theory has no answer to this question.

Use the classical (RBC) IS—LM—FE model to show the effects on the economy of a temporary adverse supply shock; for example, an increase in the price of oil

You should show the impact on the real wage, employment, output, the real interest rate, consumption, investment, and the price level.

Which of the following explains why pork-barrel spending is often approved, even when the spending is inefficient?

What will be an ideal response?

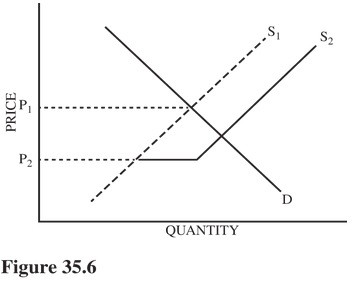

Refer to Figure 35.6: If S1 represents the U.S. domestic supply of a good, what does S2 most likely represent?

Refer to Figure 35.6: If S1 represents the U.S. domestic supply of a good, what does S2 most likely represent?

A. Production possibilities under conditions of free trade. B. U.S. supply under tariff-restricted trade. C. The result of a foreign country dumping this good on the U.S. market. D. U.S. supply under quota-restricted trade.