Tonix Corporation produces two products, P and Q

P sells for $7.00 per unit; Q sells for $6.00 per unit. Variable costs for P and Q are $3.00 and $5.00, respectively. There are 3,300 direct labor hours per month available for producing the two products. Product P requires 2.00 direct labor hours per unit, and product Q requires 2.00 direct labor hours per unit. The company can sell up to 300 units of each kind per month. What is the maximum monthly contribution margin that Todd can generate under the circumstances? (Round to nearest whole dollar.)

A) $1,200

B) $1,350

C) $2,550

D) $17,850

C .C)

P Q

Sales price $7.00 $6.00

Variable costs 3.00 5.00

Contribution margin $4.00 $1.00

Direct labor hour per unit 2.00 2.00

Contribution margin per direct labor hour $2.00 0.50

Ranking 1 2

Hours

No. of units available

Total 3,300

P 300 600

Q 1,350 2,700

P Q Total

Sales revenue $2,100 $8,100 $10,200.00

Variable cost 900 6,750 7,650.00

Contribution margin $1,200 $1,350 $2,550

You might also like to view...

Why might a citizen not want to file suit under the False Claims Act against a company that has committed major fraud against the federal government and is now in bankruptcy?

a. When in bankruptcy, company executives are free from prosecution for financial issues. b. The company’s failure in the marketplace is already under a law suit. c. There is little point in filing suit if the company is unlikely to be able to pay back any of the money. d. The False Claims Act specifically protects companies in bankruptcy from prosecution.

Under accrual accounting, revenue is recognized:

A) when cash is received, and expenses, when cash is paid. B) when cash is received, and expenses, when they are incurred. C) when it is earned, and expenses, when the costs are incurred. D) When it is earned, and expenses when cash is paid.

List the four properties of linear programming models and provide an example of a violation of each

What will be an ideal response?

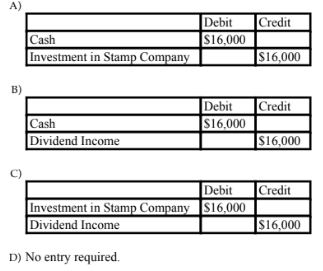

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income, what entry will the company make to record the dividends received from Stamp Company for 2016?