Firms that issue callable bonds have the option of repaying the principal to the bond buyers before the stated maturity date for the bonds. Firms may call their bonds before maturity in order to avoid making some of the coupon payments

Should we expect the price of a callable bond to be higher or lower than the price of a non-callable bond that has the same coupon payment, principal, and effective yield? A) Price of the callable bond should be higher

B) Price of the bonds should be the same

C) Price of the callable bond should be lower

D) We need to know the year in which the bond is called in order to compare the prices

C

You might also like to view...

Marginal social cost is equal to the

A) sum of marginal private cost and marginal external cost. B) sum of marginal private cost and marginal private benefit. C) marginal cost incurred by the producer of the good. D) marginal cost imposed on others.

The introduction of the euro has eliminated currency as a barrier to trade in all European countries.

a. true b. false

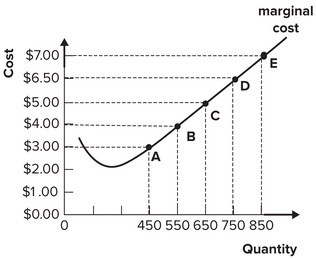

Refer to the graph shown depicting a perfectly competitive firm. If average variable cost is $3 at quantity 450, points A through E represent the:

A. demand for the firm's product. B. firm's supply curve. C. firm's total revenue curve. D. firm's total cost curve.

The chairperson of the Federal Reserve Board of Governors:

A. sits on the Federal Open Market Committee. B. is appointed by the President and confirmed by the Treasury. C. serves a fourteen-year term as chairman. D. is always the president of the Federal Reserve Bank of New York.