Franco and Elisa share income equally. During the current year the partnership net income was $40,000. Franco made withdrawals of $12,000 and Elisa made withdrawals of $17,000. At the beginning of the year, the capital account balances were: Franco capital, $40,000; Elisa capital, $58,000. Franco's capital account balance at the end of the year is

A) $74,500

B) $62,500

C) $60,000

D) $48,000

D

You might also like to view...

Which of the following is NOT a part of the win-win strategy?

A. discourage differences of opinion B. assume a person can be trusted C. listen to everyone involved D. remain optimistic about finding an answer

What are the advantages and disadvantages of taking your case to small claims court? Refer to text

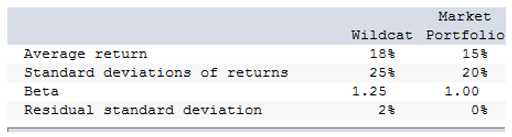

Calculate Treynor's measure of performance for Wildcat Fund.

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

A. 1.00%

B. 8.80%

C. 44.00%

D. 50.00%

Zhang Industries budgets production of 300 units in June and 310 units in July. Each unit requires 1.5 hours of direct labor. The direct labor rate is $14 per hour. The indirect labor rate is $21.00 per hour. Compute the budgeted direct labor cost for July.

A) $6,300. B) $6,510. C) $9,450. D) $9,765. E) $16,275.