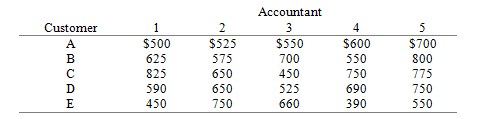

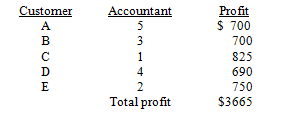

Five customers needing their tax returns prepared must be assigned to five tax accountants. The estimated profits for all possible assignments are shown below. Only one accountant can be assigned to a customer, and all customers' tax returns must be prepared. What should the customer–accountant assignments be so that estimated total profit is maximized? What is the resulting total profit?

What will be an ideal response?

You might also like to view...

Dollar discount stores and closeout chains are both types of off-price retailers.

Answer the following statement true (T) or false (F)

Whether a customer assumes the role of competitor is unaffected by trust, control or time.

Answer the following statement true (T) or false (F)

Which of the following criteria represents the dollar amount of change in the value of the firm as a result of choosing a decision?

A) net present value B) payback period C) return on investment D) internal rate of return

Omni-Lite IndustriesOmni-Lite Industries is involved in the development, production, and marketing of specialized metal matrix composite, aluminum, and carbon steel products. The company is planning to implement flexible manufacturing to enable mass customization.Which of the following additional pieces of information would most strengthen the idea of implementing a flexible manufacturing system?

A. Aluminum and carbon steel products are considered commodities and offer very little value for differentiation. B. Majority of the company's sales revenue comes from small-sized organizations that have varying requirements. C. The company has already purchased a logistics software, which is useful in managing operations. D. The company procures necessary raw materials from a single vendor, with whom it shares a partnering relationship.